Part 1 of 3 - How digital enables growth in Insurance and the considerations required

Share:

Date:

May 2023

key fact

Digital capability remains a key investment area for Insurers seeking to achieve their strategic goals

In the first of a series of three insights on what digital transformation means for Insurance firms, Managing Consultant and industry expert Mike Kingston, gives us an overview of the challenges and talking points within the industry.

Opportunities for growth

Despite the challenges in the wider economy over the last year, there remain great opportunities for growth within the Insurance industry, and the Financial Services sector as a whole.

Underlining this growth and a focus for continued serious consideration is improving customer experience to retain profit and attract new revenues. Understanding what their customers are looking for has proved to be a sticking point for insurers previously. Digital experience has improved this with better access to information and services, but opportunities remain to offer more tailored service to customers, especially given the data at insurers’ disposal. This can enable multi-line insurers to assess a customer’s complete needs, and insure them as a ‘whole’, rather than a series of disparate products to manage.

A move to becoming a data led organisation is more than trending technology jargon where the industry is concerned, as data accrued by insurance companies can be invaluable in offering a better service to their clients. Firms have access to vast data sets that, utilised well, can drive new innovating services in claims, real time product offerings, and much more personalised pricing accuracy, alongside efficiencies in supply chain and more accurate financial analysis.

Figure 1 – current organisational challenges

Insurance is no different to other industries and organisations are looking to address the challenges they face by leveraging digital to build a business ecosystem that seamlessly connects products, operations, sales, and supply chain networks, and having the organisation adopt modern ways of working to deliver products, and value, to the market quicker. With sustainability and ethical impact of a business being a big conversation, Environmental, Social, and Governance (ESG) factors are also high on the agenda for Insurers aiming to meet eco targets and customers’ expectations, both in their supply chain and with new product offerings already entering the market.

Current trends in Insurance

While the core purpose and model of insurance is unlikely to ever change, it is widely accepted that the Insurance industry needs to adapt to the evolving ecosystems in which we now live. To this end there are several trends, each at different stages in their life cycle, that insurance companies should be reviewing. Putting the customer first and at the core of everything remains an overarching priority and this leads to the themes we see below:

Usage based – not only how behaviour impacts the risk but also considering insurance for a time-boxed period. Telematics has been one of the earliest examples of usage-based insurance and is only set to expand with the growing datasets available from vehicles. The growth of sensors at home and in commercial premises also provide opportunities to look at products differently. Another challenge is to take the simple principle behind a single-trip travel product and build this into other product lines.

Intangible risks – for example, cryptocurrency, insurance in the metaverse, such as for Non-Fungible Transactions – while in its infancy and not an issue for majority of customers today, it deserves consideration for what it may become.

Personalised solutions – insuring a person, taking the customer’s specific needs into account, and providing the portfolio of solutions rather than individual product lines and pricing.

Prevention – building on the work that has been done in the industry to date and utilising the available technology in minimising risk e.g., on leak prevention solutions, the sensors in a car and how they can prevent crashes or how they can expedite a response in a claim situation, thermal imaging for buildings to forewarn customers, wearables for Health and ability to monitor and change habits.

Real time needs – insure me instantly when I need it e.g., ad hoc travel, single-trip car journeys.

Embedded – included at the point of sale e.g., built into the price when buying a car. The insurance is not seen as a separate purchase.

Constant innovation, collaboration with partners and exploiting new technologies enable insurers to update the solutions on offer and meet the demands of the modern-day customer.

Why digital? And why the need to embrace it?

Let’s start by setting out what we really mean by digital and simplifying it into something more tangible. When we say digital, we really mean a business strategy and/or operating model that uses the capabilities of modern technologies to meet the demands of customers and deliver the organisation’s ambitions in a different way.

While the most visible element of digital is in the customer experience (as driven by organisations such as Apple, Google, Amazon, Meta), digital actually comprises a number of different layers, from the customer experience through to the infrastructure foundations required.

Building and evolving the digital capabilities of an insurer supports growth and raises revenues by providing new channels to market and by significantly improving that important customer experience. Accelerating digital can also support the efficiency gains organisations are looking for and help fund any transformation required.

Technology continues to evolve rapidly, enabling organisations to devise strategies that until recently would have been unaffordable. This trend is set to continue. So, while the opportunity and challenge facing Insurance CxOs is massive, driving transformational change and seamlessly integrating new digital capabilities that limit disruption to business as usual, requires thorough evaluation.

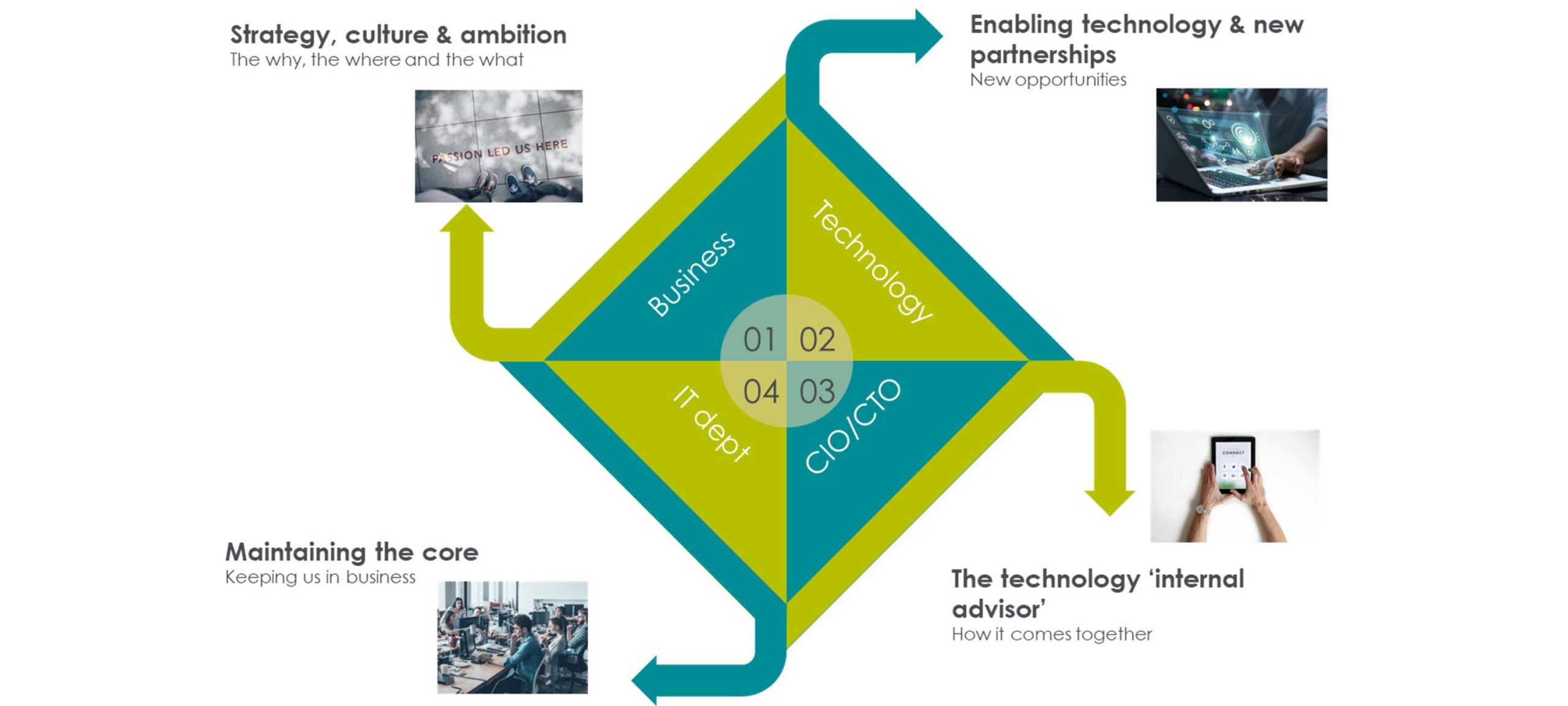

Figure 2 – how digital underpins growth

Differing roles in a digital world

As we utilise technology more and more, the roles in the organisation need to reflect how it embraces the new opportunities technology provides, bringing a slight change in emphasis to the traditional technology department:

Executive – as a whole, the organisation needs to set the culture for embracing technology to achieve the business outcomes. While technology drives the solutions, unless the evolving mindset needed for a digital world is embedded, the full value of the investments made will not be crystallised.

New partnerships – there is the potential for an explosion of technology across the organisation, through new and existing collaborations and partnerships, both internally and externally. All with the purpose of harnessing the power of new technologies to improve outcomes for customers.

CIO/CTO – needs to drive the overall technology ecosystem whilst balancing the pressure to reduce costs with setting the foundations for the business to collaborate with technology partners / innovators / Insurtechs.

IT department – moving the focus of the internal IT department to the core platforms and technology at an enterprise level, becoming the integrator, and keeping the lights on. IT departments have often worked with the concept of ‘shadow IT’ – IT applications supported within teams outside of the IT dept – with the aim of bringing it within their scope for various reasons. It may now be time for a re-think to ensure this does not hinder the agility of the business to progress with the opportunities for collaborations and partnerships mentioned.

Figure 3 – the differing roles in a digital world

There is much for insurance organisations to consider as they continue to adapt to operating in a digital world and this is before we even begin to discuss specific areas of technology focus. In a future article we will explore the six areas that should be considered:

- Keeping you safe online

- Intelligent data insights

- Flexible infrastructure

- Efficient and effective basics

- Modern ways of working

- Maximising modern technology

In the meantime, we invite analysis of the points raised in the article, and would be interested in hearing your thoughts too. Are you thinking about digital in the most effective way for your organisation? Rather than seeing digital as purely a technology change, have you considered the change in thinking and operating required to facilitate it? Have you joined up the thinking across your organisation to achieve your goals, or are you working in silos?

If you would like to speak to Mike Kingston regarding the insight email our Financial Services & Insurance team to discuss further.

To download the insight click here

To read the Part 2 and 3 of this three part series, click on the links below:

- Part 2 of 3 – How Digital enables growth in Insurance and the considerations required – Technology

- Part 3 of 3 – How digital enables growth in Insurance and the considerations required – Customer experience & digital

If you would like to speak to Mike Kingston regarding any of the insight articles, email our Financial Services & Insurance team to discuss further.

To find out about the services we provide click here.